Table of Content

To claim your food expenses and other deductible travel expenses, make sure you keep the receipts for all your food purchases and meals. This does not apply if you have already received an allowance from your employer for these food expenses. According to the ATO, costs involving financing, holding and maintaining accommodation or rent when travelling to perform work duties may be deductible as work-related travel expenses. This is typically if you are on a temporary assignment rather than a long-term arrangement. Finally, note that you can only claim for eligible work-related expenses, as per typical ATO rules.

A travel diary should indicate the date of your trip, your destinations, your itinerary, the purpose of your trip, and what costs you incurred. If you can, also keep a copy of any relevant receipts or invoices for these additional expenses. The Living Away from Home Allowance refers to an amount directly paid to a worker in a living-away-from-home arrangement. This is an allowance aimed to reimburse the expenses, rigours, and potential isolation of these work arrangements. If you provide laptops, tablets, computers, and office supplies then these are also non-taxable if they are mainly used for business purposes and not significant private use. In this article we take a look at what equipment, services or supplies are taxable if your employees are working from home due to coronavirus.

Стратегия в реальном времени. What Happens to Disconnected Phone Numbers. No data, no passwords, no access, nothing.

However, if not declared on your tax return, you will not be able to claim tax deductions on related expenses. This means you can claim the cost of your accommodation, meals, and other incidentals on your tax form as they’re incurred during your work-related travel. However, those expenses must have actually been incurred and be on the list of allowable deductions. Just because you received a travel allowance does not mean that you can claim a tax deduction.

Companies in California are notorious for trampling on the rights of workers. Can create a stipend for the anticipated costs of remote working. You can make the 20-step commute from your bedroom to your office in a little under four seconds. Abdul works for a statutory authority in Brisbane who permanently closed all their offices at the end of January 2022.

File

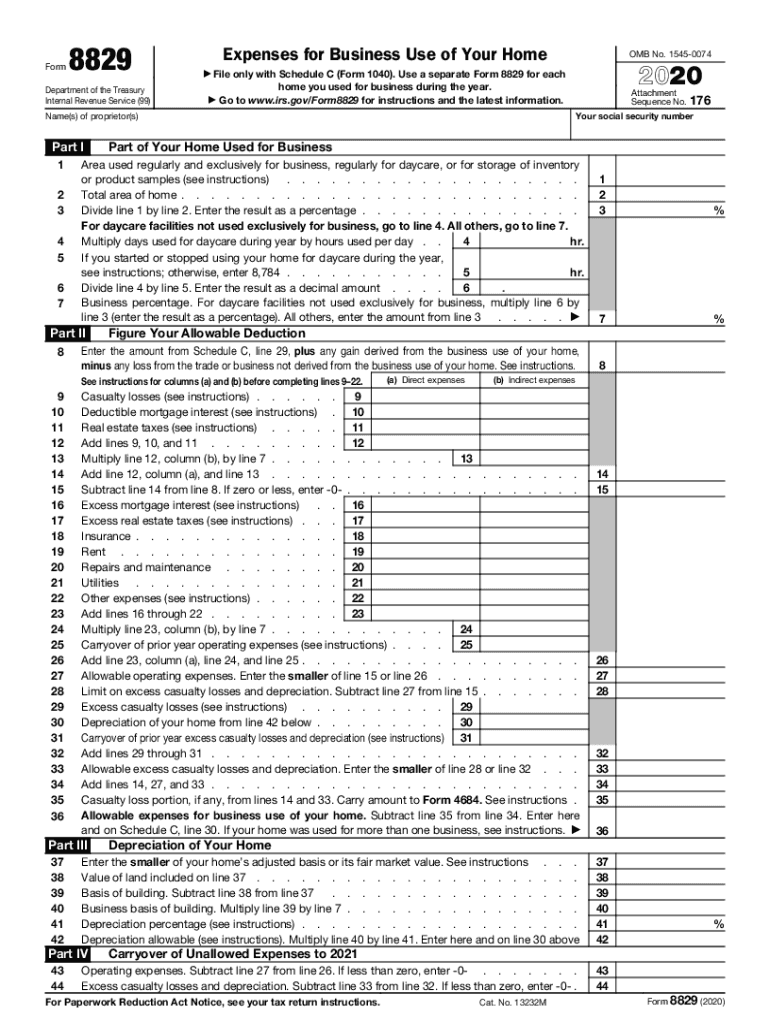

Being reimbursed for an expense is almost always better than taking a deduction for the same expense on your taxes. The other way to claim the home office deduction is by using the direct method. This involves tracking all of your home office expenses in addition to any costs related to repairing and maintaining the space. Further, you can claim deductions for a portion of other expenses based on the proportion of the space to the rest of your residence. To understand more about how you can claim tax deductions when working from home, take a look at the following tax tips for employees. Well, the IRS reserves them for self-employed independent contractors.

Here, you will learn more about claiming home office expenses on a tax return and other deductibles you can apply for. As long as your travel expenses are related to your work, and the expense is declared as part of your income, you can claim these expenses as tax deductions. To claim deductions for a trip when you’ve received a travel allowance, you must declare the travel allowance on your tax return. Expenses for working from home are not deductible for most employees since the 2017 tax reform law.

Employer provided loans

It pays to know you’re entitled to claim back expenses for using your home as an office, so you know exactly what you can and can’t claim expenses for. You can deduct actual expenses or the standard mileage rate, as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses. Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business.

Also, you may not deduct travel expenses at a work location if you realistically expect that you'll work there for more than one year, whether or not you actually work there that long. Generally, your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home. For example, you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. You may not deduct any of your travel, meals or lodging in Milwaukee because that's your tax home. Your travel on weekends to your family home in Chicago isn't for your work, so these expenses are also not deductible. If you regularly work in more than one place, your tax home is the general area where your main place of business or work is located.

Can you still FaceTime if your phone is disconnected.

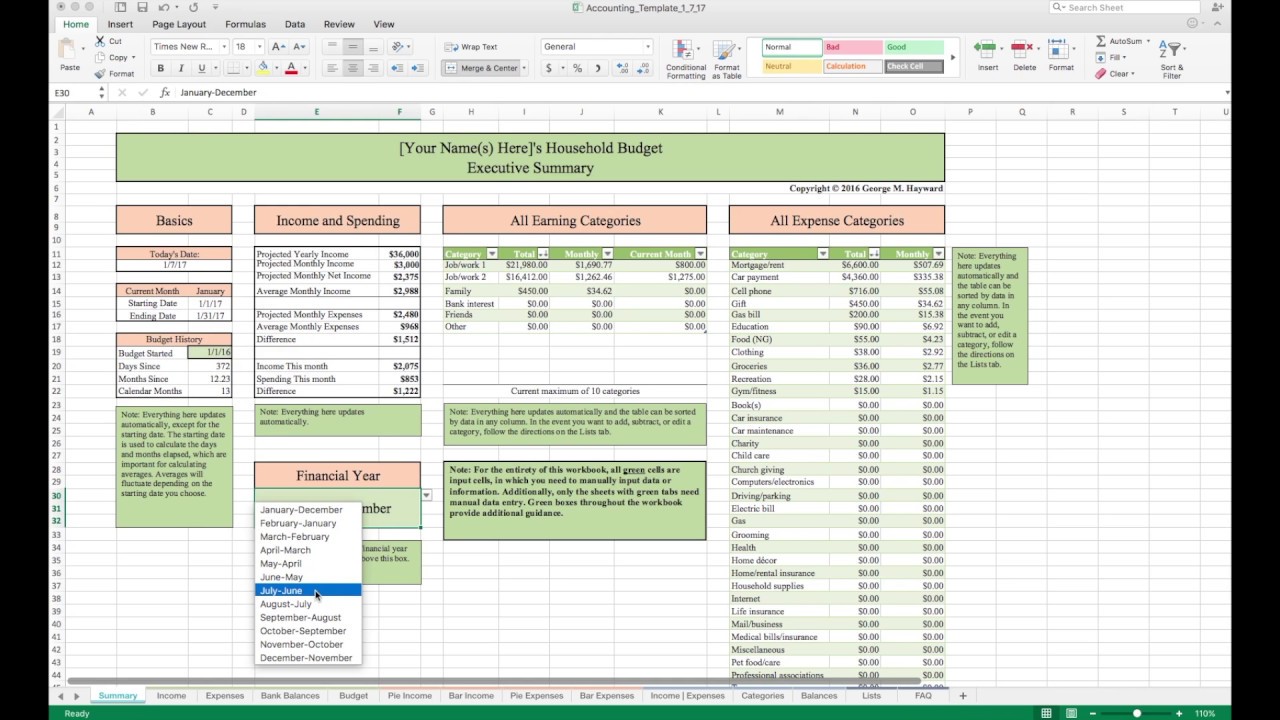

For more information on these and other travel expenses, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses. If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. You can claim a percentage of expenses such as rent, mortgage interest, utilities, insurance, and repairs. Depreciation is also an allowable expense for a home that you own. Calculating the home office deduction under the simplified method is straightforward.

Expenses for an addition of a work event while on vacation or days off. While in your vacation destination, you decided to attend a 2-day work-related conference. However, you can’t claim the accommodation or travel costs related to the trip. That’s because the original purpose is to enjoy a holiday, not attending a business-related event.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. Just answer simple questions, and we’ll guide you through filing your taxes with confidence. If your home office is a separate structure then it does no have to be your principal place of business. The employee returned any excess reimbursement to their employer within a reasonable period of time. California remote employees are entitled to reimbursement for all of their reasonable financial job-related losses.

A side note - if you’ve agreed with your employer to work at home voluntarily, or you choose to work at home, you cannot claim tax relief on the bills you have to pay. Some companies offer more to their remote workers, some offer less. However, as a bare minimum, HMRC states that your employer can pay you up to £6 a week (£26 a month) to cover your additional costs if you have to work from home. This allowance is free from tax, so you will receive the full sum.

The lists reflect only the types of expenditure that may typically be incurred in relation to maintaining a home office. State your policy about private use to your employees, setting out the circumstances under which private use is allowed. Aaron is a Chartered Accountant with over 15 years experience in the accounting industry. Aaron has been able to provide advice around structuring, cashflow, tax compliance and working with clients to develop strategies. This article is provided as general information only and does not consider your specific situation, objectives or needs. WealthVisory Accounting makes no warranties about the ongoing completeness or accuracy of this information.

For deducting home office space on your tax return, the IRS requires these expenses to be used exclusively for your self-employed business. The number of employees working from home has grown considerably due to the COVID-19 pandemic. Just a few years ago, these employees may have been eligible for tax deductions that were unavailable to in-office employees. Now, with only a few exceptions, only self-employed people are eligible to claim tax deductions when working from home. If you’re an employee, you can claim certain job-related expenses as a tax deduction, but only for tax years prior to 2018. For tax year 2018 and on, unreimbursed expenses and home office tax deductions are typically no longer available to employees.

Travel and entertainment expenses are down, again as a result of pandemic-related travel decline. But home office expenses of whatever variety are no longer deductible except for a handful of exceptions. Whenever you hire experts to help your business, you can apply for tax deductibles on their services.

Thankfully, you don’t need to keep any receipts to claim the flat-rate tax relief that HMRC offers. You can only claim for things to do with your work, for example, business telephone calls or the extra cost of gas and electricity for your work area. It’s not possible to claim for things that you use for both private and business use - HMRC states that claiming on rent or broadband access is out of the question. Photo byContent PixieThe coronavirus pandemic has meant that the vast majority of firms have now closed their offices and moved to remote working to help protect the health of their employees.

No comments:

Post a Comment