Table of Content

You need to keep accurate records of any expenses you claim as a deduction. The IRS recommends keeping a written record or log book in the event any questions arise about your deductions. If you only worked as an employee during the tax year, you can't typically claim home office expenses related to your work. If, however, you worked for yourself in some capacity, you might be able to deduct home office expenses. Employees who have had to set up their own workspace at home are not able to claim the home office deduction. Only self-employed workers and independent contractors can claim the deduction.

You can pay approved mileage allowance payments of 45p per mile up to 10,000 miles free of tax and National Insurance contributions. If you provide a mobile phone and SIM card without a restriction on private use, limited to one per employee, this is non-taxable. Deducting expenses for working from home can get complicated and an experienced financial advisor can be a great help.

Who Qualifies for Work-From-Home Tax Deductions?

You can only claim for the proportion of the cost which is linked to your business use. This is typically calculated by looking at the number of rooms that you use for business use, and the proportion of time that the space is used for business use. If you work from home, whilst you may save money on areas such as transportation, meals out etc you will still incur several running costs linked to working from home. But if you are self-employed there are a number of allowable expenses linked to these running costs which you can claim for and deduct from your earnings to work out your taxable profit. To claim travel expenses as a tax deduction, keep documentary evidence of expenses such as bank statements, credit card bills, and receipts.

To claim your food expenses and other deductible travel expenses, make sure you keep the receipts for all your food purchases and meals. This does not apply if you have already received an allowance from your employer for these food expenses. According to the ATO, costs involving financing, holding and maintaining accommodation or rent when travelling to perform work duties may be deductible as work-related travel expenses. This is typically if you are on a temporary assignment rather than a long-term arrangement. Finally, note that you can only claim for eligible work-related expenses, as per typical ATO rules.

Check which expenses are taxable if your employee works from home due to coronavirus (COVID-

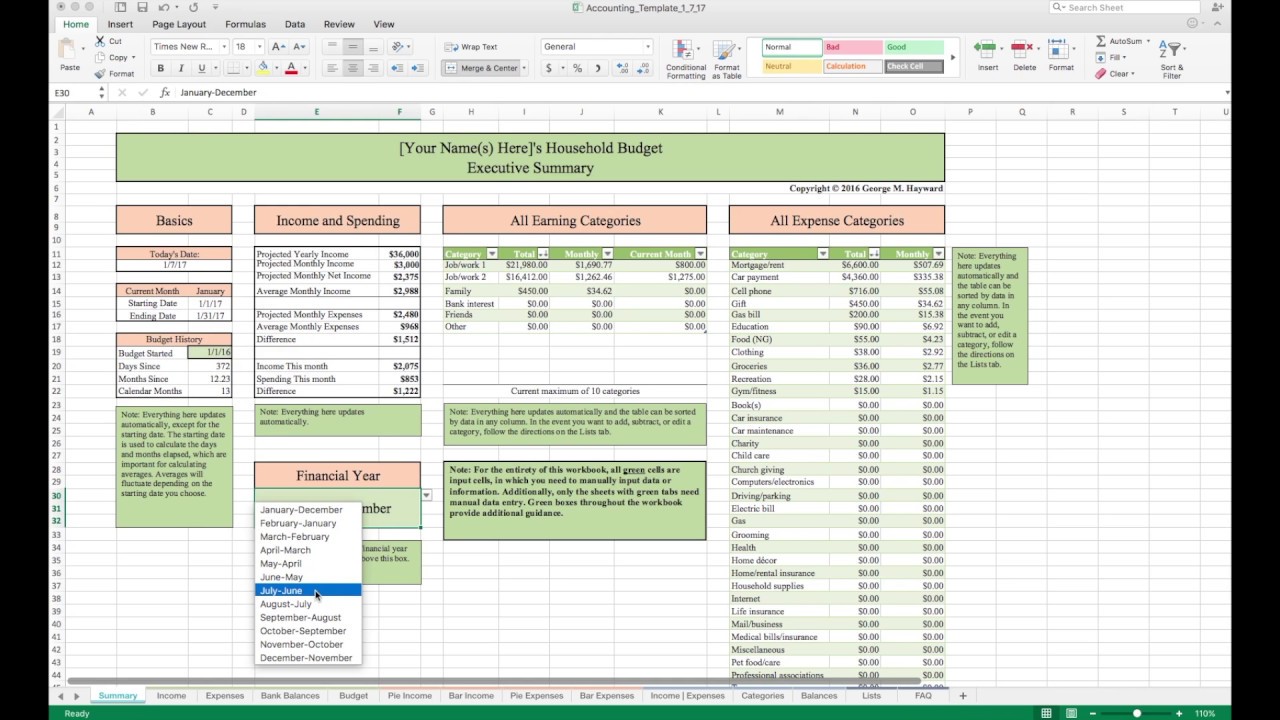

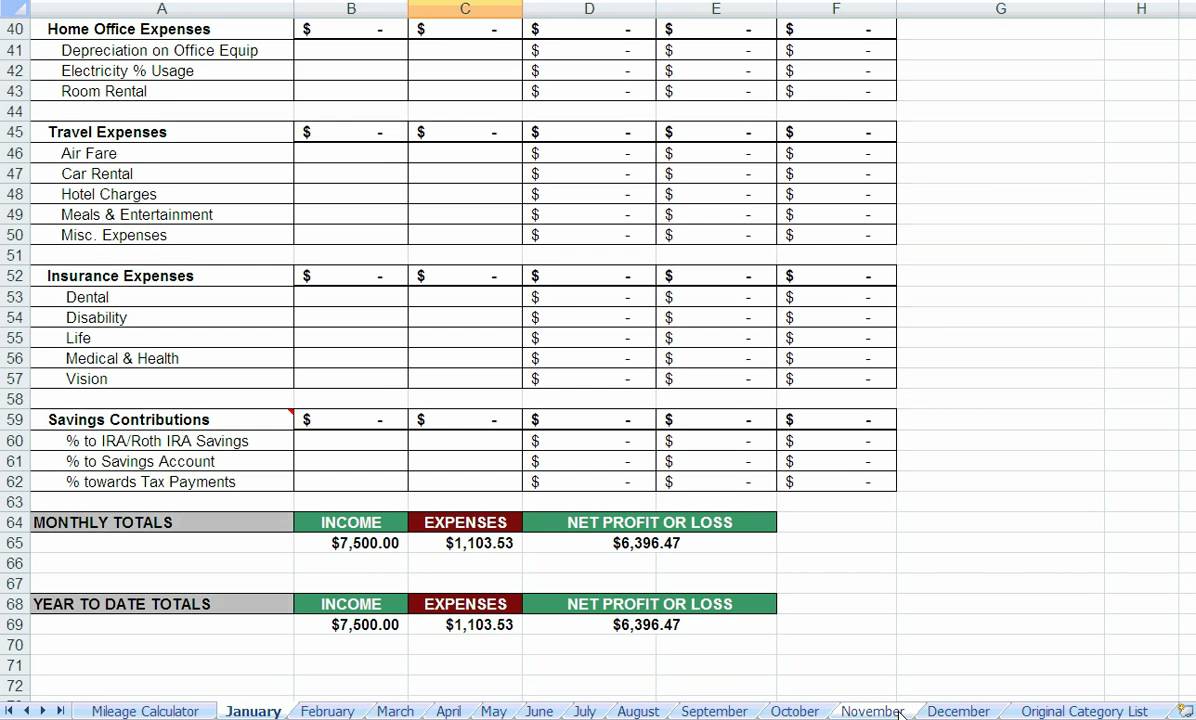

The direct method determines the home office tax deduction based on the percentage of your home office square footage to your entire home. • You can choose between two methods for calculating your business use of home tax deductions, the simplified and direct methods. When an employer pays for home office equipment, though, it is often still the company’s property. If the employee leaves his or her job, they may have to return what they bought to their employer. This IRS form is then attached to the main 1040 tax return and the work from home expenses are reported on Schedule A, the schedule for itemized deductions. Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions.

For people filing for tax years before 2018 work from home deductions can be used. Also, the current limitation on deductions is set to expire in 2025, so after that tax year expenses for working from home will again be deductible for many employees. However, some groups of employees may still be able to take these deductions. And self-employed independent contractors still can deduct expenses for home offices. Employers may be able to reimburse employees for necessary expenses and then deduct the outlays as business costs. It’s possible to claim more if your costs are higher, but it becomes a much more labour intensive process as you’ll need to set up a rental agreement between you and your limited company.

Is Living Away From Home Allowance Taxed?

Meal expenses during overnight travel can be claimed as a tax deduction. This only applies when you are travelling away for work on overnight trips. These expenses aren’t tax deductible if you are living away from home or relocating. For example, let’s say your employer provides you $2000 worth of travel allowance for the year, but your travel cost throughout the year only amounts to $1500.

It does not represent financial advice upon which any person may act. Implementation and suitability requires a detailed analysis of your specific circumstances. For friendly professional tax advice you can trust, make an appointment with WealthVisory Accounting. Examples of this include watching a movie, buying a book, booking a tour, etc. The ATO releases a Taxation Determination annually to outline what the office considers a reasonable travel and overtime meal allowance. Living away from home requires you to live in suitable accommodation on or near your workplace, away from your typical home.

Here’s what taxpayers need to know about the home office deduction

Typically, if you are employed and choose to work from home, you are not able to claim expenses or tax relief on costs incurred. Here are some frequently asked questions regarding working away from home tax deductions. Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules.

” is a common question most self-employed people or home-based workers ask. Taxpayers may be eligible to various tax deductions at the end of the tax year. If you want to know more about how you can write off taxes working from home, this article is for you!

If you have worked from home, even if for just one day, you can claim the tax back. Under the scheme, your tax code is adjusted so you're not paying as much tax. And with energy bills at an all-time high, it's important to understand if you can get money back if you're forced to work from home due to severe weather. When a part of your home is used as a home office, that part is considered to “taint” the primary residence exclusion for CGT purposes. If you have missed the live streaming, it’s now available to watch here. Be aware that your decision to not recover the cost of private use is not a reward but a commercial decision.

Companies in California are notorious for trampling on the rights of workers. Can create a stipend for the anticipated costs of remote working. You can make the 20-step commute from your bedroom to your office in a little under four seconds. Abdul works for a statutory authority in Brisbane who permanently closed all their offices at the end of January 2022.

You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. However, you can't deduct travel expenses paid in connection with an indefinite work assignment. Any work assignment in excess of one year is considered indefinite.

So make sure to keep the invoices of IT specialists, attorneys, and accountants for a tax deductible. Taking professional education or training to help your business grow is one of the things you can write off at tax time. If you want to develop more skills to help improve your profession and business, you can apply for tax deductibles on these classes. You won't get a one-off payment when claiming for this year, instead, it will be included as part of your weekly or monthly payments from your employer.

Since the 2018 tax reform became law, generally only self-employed people can claim tax deductions when working from home. Working as an employee and for yourself doesn’t necessarily disqualify you from taking these tax deductions. The deductions have to be related to your self-employed income rather than your employee work. One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction.

Special rules apply to conventions held outside the North American area. All features, services, support, prices, offers, terms and conditions are subject to change without notice. The IRS allows you to deduct expenses for having a dedicated space where you regularly and exclusively conduct your self-employed business. This is true whether you live in a house, apartment, condo, mobile home or boat, as well as external structures like a barn, garage or workshop. If you use your home office for your W-2 job and your side gigs, you won’t be able to claim your home office as a tax deduction.

No comments:

Post a Comment